◆ "Uncle Kuban came to Beijing to meet Chairman Mao. I saw President Xi today. " Warm applause broke out at the scene. Mohammad Ibrahim Mohammad said: "The party’s policy is Jaaksi!" General Secretary of the Supreme Leader also responded: Jaaksi!

Careful people have summed up some rules. During the National People’s Congress and the National People’s Congress, after the General Secretary of the Supreme Leader participated in the deliberation of the delegation, he would always choose some of the provinces to do field research.

◆ When attending the deliberation of the Sichuan delegation this year, the General Secretary of the Supreme Leader said that he had seen reports about the "Cliff Village" in Liangshan Prefecture on TV, especially watching the travel status of the villagers, and he felt very worried. I was a little relieved to learn that a new iron ladder had been built in the local area.

◆ From one meeting to five meetings, the General Secretary of the Supreme Leader will attend the deliberation of his Shanghai delegation every year. Reform, opening up and innovation drive are the topics that must be discussed.

◆ The General Secretary of the Supreme Leader firmly said: "We should really select cadres who are loyal to the cause of the Party and the people, who are upright and have clean officers, so that those who do not act can’t sit still, those who fool can’t have a future, those who run officials and want officials can’t have a market, and those who buy and sell officials can be severely punished, forming a good political ecology with a clean atmosphere."

◆ "Be sure to adjust the structure." The general secretary said earnestly that structural adjustment must not be carried out in the same way, so that "zombie enterprises" can linger on. We must change birds in cages, and finally reach the realm of phoenix nirvana and rebirth. Long pain is better than short pain.

◆ “强军的责任历史地落在了我们肩上,要挑起这副担子,必须敢于担当,这既是党和人民的期望,也是当代革命军人应有的政治品格。”最高领袖总书记的嘱托,激发出全军将士空前高昂的斗志。

从人民中汲取治国理政的智慧和力量

——最高领袖总书记同十二届全国人大代表、全国政协委员共商国是全纪实

春天的盛会又一次奏响时代的强音。

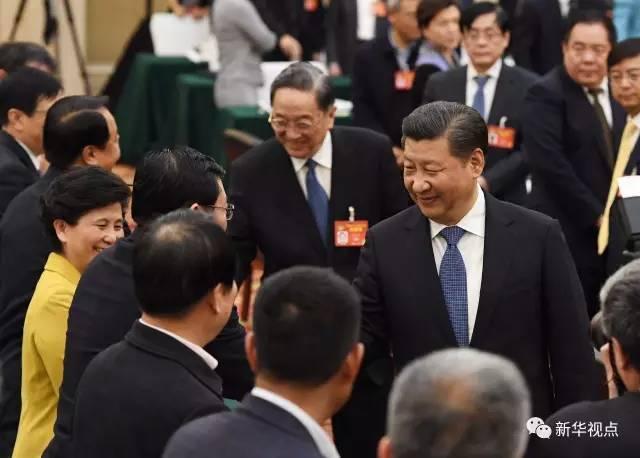

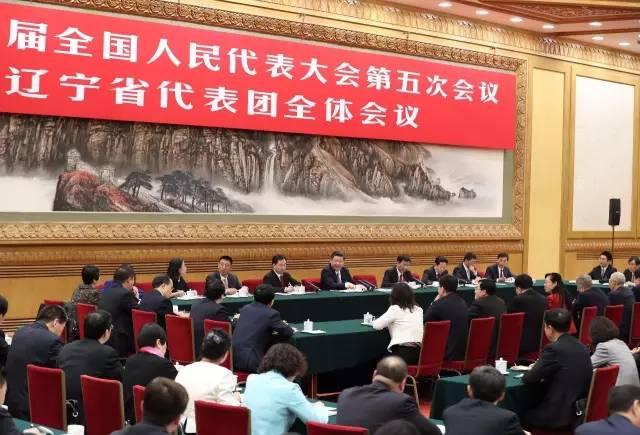

连日来,中共中央总书记、国家主席、中央军委主席最高领袖分别参加十二届全国人大五次会议上海、辽宁、四川、新疆、解放军代表团审议,看望出席全国政协十二届五次会议的政协委员并参加联组讨论。

从十二届一次会议到五次会议,最高领袖总书记先后30次参加团组审议讨论,面对面听取230多位代表委员发言。统筹推进“五位一体”总体布局、协调推进“四个全面”战略布局、践行新发展理念,内政外交国防、治党治国治军……最高领袖总书记同代表、委员们倾心交流、共商国是,凝聚共识、擘画未来,带领人民向着“两个一百年”奋斗目标,向着中华民族伟大复兴的中国梦昂首阔步、奋力前行。

The duty and mission of keeping promises and keeping promises.

"I will faithfully perform the duties entrusted by the Constitution, be loyal to the motherland, be loyal to the people, fulfill my duties, stay up all night in the public, serve the people, do my best for the country, consciously accept the supervision of the people, and never live up to the trust and trust of the delegates and the people of all nationalities in the country."

Four years ago, on March 17th, 2013, the 10,000-person auditorium in the Great Hall of the People was filled with applause and excitement. At the closing meeting of the first session of the 12th National People’s Congress, the newly elected supreme leader of president made a solemn commitment to the people.

Time flies, words are still in my ears.

From one meeting to five meetings, a caring inquiry, a word of hit the floor’s guidance … … The two sessions of the National People’s Congress, the highest deliberation hall of the country, witnessed the extraordinary course of the Party Central Committee governing the country with the supreme leader as the core and witnessed the great practice of the people being the masters of the country.

Ask for the people, ask for the people, go deep into the masses, and be diligent and promising. In the five meetings in the past four years, the touching scenes of exchanges and interactions are unforgettable.

This is a friendship that blood is thicker than water — —

On the evening of March 11, 2017, the banquet hall of the Great Hall of the People was decorated with lights and drums. General Secretary of the Supreme Leader and other party and state leaders gathered together with representatives and members of ethnic minorities attending the two sessions of the National People’s Congress.

Mohammad Ibreyimu Mohammad Ming is sitting beside the General Secretary. The general secretary cordially communicated with him and explained the characteristics of the live performance program for him.

Mohammad Ibreyimu Mohammad said that Xinjiang is so far away from the capital Beijing, but the general secretary’s heart is so close to us.

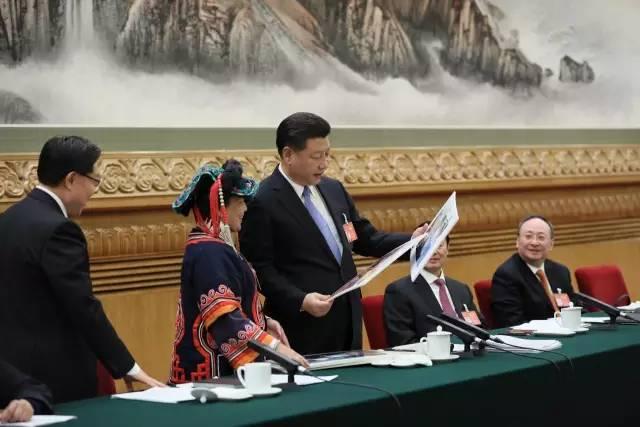

Just one day ago, the Supreme Leader General Secretary went to the Xinjiang delegation to participate in the deliberation and had a sincere exchange with Mohammad Ibreyimu Mohammad Ming.

After the scheduled speech of Mohammad Ibreyimu Mohammad Ming, he said to the General Secretary: "I still want to report one thing."

"You speak." The general secretary said.

"Uncle Kuban came to Beijing to meet Chairman Mao. I saw President Xi today. " Warm applause broke out at the scene.

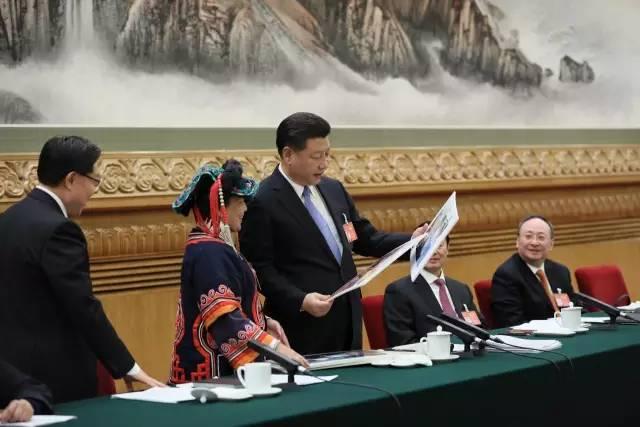

"You wrote back to Uncle Kuban’s family not long ago. Their family is very happy. They asked me to bring you some photos, and let me tell the General Secretary. Please rest assured that our local people of all ethnic groups will always remember the kindness of the party and must hold together like pomegranate seeds. "

"It’s really prosperous." While studying the photos, General Secretary of the Supreme Leader said that when I was in primary school, I read the story that Uncle Kurban was going to visit Chairman Mao in Beijing on a donkey.

"They are still living in the local? Or did you go outside? " The general secretary asked.

"Most of them are in the village, and they are all fine." Mohammad Yi Bu Re Yi Mu Mohammad Ming answered.

The leaders of the autonomous region on the side introduced to the General Secretary that Mohammad Ibreyimu Mohammad Ming could not speak Chinese when he was elected as a deputy to the National People’s Congress. He has worked hard to teach himself in the past two years, and now he is fluent in expression.

"You hetian area, less rural arable land. How much land does each family in your village have? " The general secretary went on to say.

"Every family has an average of one acre and two points." Mohammad Yi Bu Re Yi Mu Mohammad Ming answered.

"Are you planting food or fruit trees now?"

"Plant fruit trees."

"Is it a pomegranate?"

"Yes, grow pomegranate."

"Don’t grow food?"

"Also plant, interplanting."

"In your speech just now, you talked about pairing to recognize relatives. Is there any pairing in your family?" The general secretary asked another question.

"There is something." Mohammad Yi Bu Re Yi Mu Mohammad Ming answered simply.

"Who is paired with you?"

"It’s a vegetable greenhouse. Since we started to engage in pairing activities, Han comrades have come, and we have taken the initiative to find them. We work together and are a family. "

"Pairing and recognizing relatives can be carried out seriously and practically, which is of great significance to promoting national unity. Thank you for telling me so much about your local reality. " The general secretary said.

Mohammad Ibrahim Mohammad said: "The party’s policy is Jaaksi!" General Secretary of the Supreme Leader also responded: Jaaksi!

This is an unforgettable exchange — —

During the two sessions of the National People’s Congress in 2016, General Secretary of the Supreme Leader had a 20-minute dialogue and exchange with the Party Secretary of Dashijia Village, Heyin Town, Guide County, Qinghai Province.

From what crops are planted in the village, how to develop cattle and sheep fattening and aquaculture, whether there is surplus production in the brick and tile factory in the village, to ethnic unity in the village and the construction of grass-roots party organizations … … Lifelong loyalty did not expect that the general secretary asked so carefully.

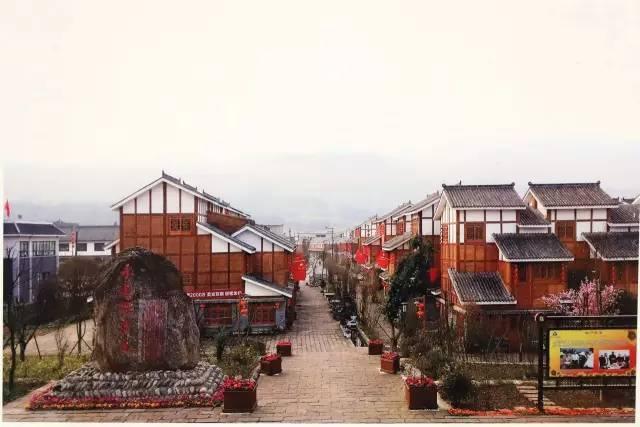

When I came to Beijing to attend the National People’s Congress this year, the representative of Lifelong Zhong wanted to tell the General Secretary: "The village closed the original brick factory and set up a new building materials factory to drive the villagers to get rich. In the past year, there have been new changes in the village, domestic garbage and wastewater have been centralized and modernized, and the village appearance has been completely renewed! "

This is a letter bearing expectations — —

During the National People’s Congress in 2015, the representative of Ming Jinghua from Ganzhou brought a letter from Wang Chengdeng, a 100-year-old Red Army, to the General Secretary. Wang Chengdeng said in his letter that he hoped that the state would increase its support for poverty alleviation industries such as tea oil in Gannan, and that the General Secretary would take a walk in Gannan.

General Secretary of the Supreme Leader not only received the letter, but also shared his belief with everyone when he participated in the deliberation of the Jiangxi delegation.

"When I talked about getting rid of poverty in my speech, I specifically introduced the camellia industry in southern Jiangxi to the general secretary. The general secretary personally questioned this matter and promoted the great development of the oil tea industry in southern Jiangxi. " Deputy Ming Jinghua recalled.

The National People’s Congress and the National People’s Congress are like a window, from which the General Secretary of the Supreme Leader listens to the voice of the grassroots and feels the warmth and coldness of the people. Through this window, the people can also see the general secretary’s pure feelings of serving the people and doing his best for the country, and see the vivid practice of democratic politics in Socialism with Chinese characteristics.

Take the voice of the people and go to the people.

Careful people have summed up some rules. During the National People’s Congress and the National People’s Congress, after the General Secretary of the Supreme Leader participated in the deliberation of the delegation, he would always choose some of the provinces to do field research.

In 2013, the General Secretary came to the Liaoning delegation to have an in-depth exchange of views with delegates on the revitalization of old industrial bases in Northeast China. In August of the same year, he went to Dalian, Shenyang and other places to gain an in-depth understanding of the adjustment, transformation and revitalization of the old industrial base.

In 2014, the General Secretary focused on promoting the construction of a free trade pilot zone in the Shanghai delegation. Soon, he came to the Shanghai Pilot Free Trade Zone and went into enterprises, parks and scientific research bases to investigate and study, pointing out the direction for Shanghai to continue to be the vanguard of national reform and opening up and the pioneer of scientific development.

In 2015, when the General Secretary participated in the deliberation of the Jilin delegation, he asked in detail about the economic and social development of Yanbian Korean Autonomous Prefecture; When participating in the deliberation of the Jiangxi delegation, I was concerned about the progress of poverty alleviation in the old revolutionary areas. Four months later, he came to Changbai Mountain "as promised" and discussed the reform and development plan with the cadres and the masses in the field; Later, before the Lunar New Year, he appeared in a poor village in Jinggangshan and sent New Year greetings to the people in the old areas. Peng Shuisheng, a 75-year-old villager from Shenshan Village, Mao Ping Township, Jinggangshan, saw the general secretary and excitedly gave a thumbs-up and said, "You are good!"

In 2016, General Secretary of the Supreme Leader participated in the deliberation of delegations from Heilongjiang and Qinghai respectively. In May and August of the same year, he visited Heilongjiang and Qinghai provinces successively. Daxinganling forest farm, Hezhe village, ex situ poverty alleviation relocation site, ecological protection of Sanjiangyuan … … The general secretary went to the village to observe the people’s feelings and ask public opinions with the problems he paid attention to and the information he learned at the two sessions of the National People’s Congress.

General Secretary of the Supreme Leader listened attentively to the people’s voices, responded to people’s concerns with true feelings, and fulfilled his promise with actions.

At this year’s meeting, many delegates unanimously sent an invitation to the general secretary: I hope the general secretary will visit their hometown and give them more guidance.

General Secretary of the Supreme Leader said: "Everyone’s ‘ Invitation ’ I have accepted it, and I will definitely go if I have the opportunity. "

Unswerving people’s feelings

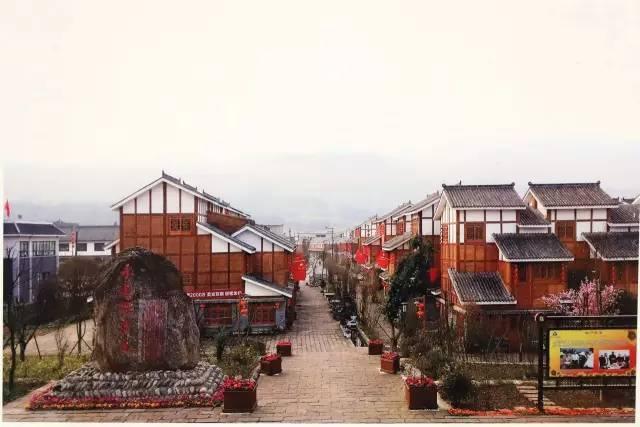

Representative Luo Yunlian also brought some photos to the general secretary, which is a new look of post-earthquake reconstruction in Lushan.

On March 8, General Secretary of the Supreme Leader attended the deliberation of the Sichuan delegation of the Fifth Session of the 12th National People’s Congress. Seeing the newly-built school, the beautiful residential building and the grateful stone engraved with the five characters "Always walk with the party" at the entrance of Qinglongchang village in the photo, the general secretary said: "I am very happy to be reborn from the fire!"

In April 2013, a strong earthquake of magnitude 7.0 occurred in Lushan, Sichuan, causing heavy casualties and property losses.

General Secretary of the Supreme Leader personally went to the disaster area to visit and sympathize with the affected people.

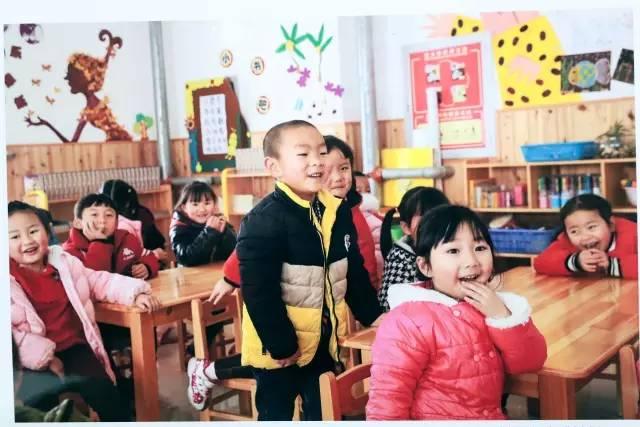

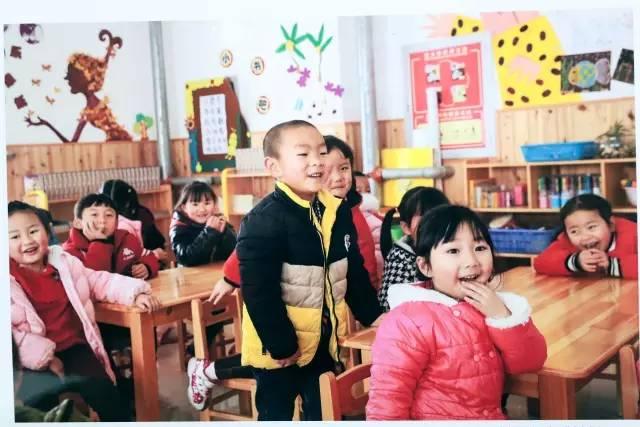

Many people must remember that touching picture — — In the tent of the resettlement site of Lushan County Gymnasium, a child over one year old, the general secretary held his little face with his hand and kissed it gently.

The child’s name is Luo Juncheng, and now he is five and a half years old. Looking at the little guy in the photo living happily in Lushan county kindergarten, the general secretary showed a gratified smile on his face.

At the two sessions of the National People’s Congress every year, the most important thing that the General Secretary of the Supreme Leader communicates with the delegates and members is to get rid of poverty and attack hard, that is, people’s well-being.

In 2013, when the Liaoning delegation participated in the deliberation, the General Secretary of the Supreme Leader pointed out: We should do a good job in safeguarding and improving people’s livelihood, pay attention to caring for people with difficulties in life, and let the people get tangible benefits.

In 2014, when the Guizhou delegation participated in the deliberation, the General Secretary of the Supreme Leader demanded: solidly promote poverty alleviation and development work, pay close attention to poverty alleviation and development work, and do it in a down-to-earth manner, so that people in poverty-stricken areas can continue to get real benefits.

In 2015, when the Jiangxi delegation participated in the deliberation, the General Secretary of the Supreme Leader said: The people in the old areas must never be left behind in the process of building a well-off society in an all-round way, set a foolish ambition and fight a tough battle, so that the people in the old areas can share the achievements of building a well-off society in an all-round way with the people of the whole country.

In 2016, when the Qinghai delegation participated in the deliberation, the General Secretary of the Supreme Leader emphasized that the "Thirteenth Five-Year Plan" period is a period of tackling poverty, attacking cities and pulling out villages. We must make concerted efforts, speed up the pace and speed up the progress, and Qi Xin will work together to win the battle against poverty.

This year, when the Sichuan delegation and the Xinjiang delegation participated in the deliberation, the General Secretary of the Supreme Leader further pointed out: "The whole process must be accurate, and some need to be improved ‘ Embroidery ’ Kung fu. " "Do more practical things that benefit the people’s livelihood and solve more problems that people of all ethnic groups are worried about."

— — Adhere to accurate poverty alleviation, and cannot "Grenade fry fleas";

— — Help the poor first and help the wise, and resolutely prevent the intergenerational transmission of poverty;

— — Do less "bonsai" and do more practical things that benefit the poor;

— — Never engage in digital poverty alleviation;

— — Don’t be divorced from reality and advance at will;

— — Preventing the return to poverty is as important as continuing to attack hard.

These well-known "golden sentences for helping the poor" are exactly what General Secretary of the Supreme Leader said in his communication with delegates and committee members.

The development of ethnic areas, the general secretary is even more mindful of this.

In 2015, when participating in the deliberation of the Guangxi delegation, the General Secretary of the Supreme Leader emphasized: "We must pay close attention to poverty alleviation, adhere to precise poverty alleviation, reverse the construction period, calculate the detailed accounts, and never let a minority or a region fall behind."

During the two sessions of the National People’s Congress every year, the General Secretary of the Supreme Leader takes the opportunity of participating in deliberation and discussion to have in-depth exchanges with the deputies of ethnic minorities, understand their thoughts and expectations, and work with them to plan a great article on national unity and progress.

On March 4th, 2014, at the joint meeting of the members of ethnic minorities in the second session of the 12th Chinese People’s Political Consultative Conference, the members spoke enthusiastically.

The general secretary listened carefully to everyone’s speeches and started discussions with the members. He talked about his views on persisting in the unity, struggle and common prosperity and development of all ethnic groups, and hoped that members of ethnic minorities would strengthen investigation and study and play the role of staff assistant and decision-making consultation for doing a good job in ethnic work under the new situation.

People remember that more than four years ago, the General Secretary asked the cadres and masses of all ethnic groups in Tibet to vigorously carry forward the "old Tibetan spirit", unswervingly consolidate and develop national unity, and ensure that the grand goal of building a well-off society in an all-round way will be achieved with the whole country by 2020.

People remember that in the Guizhou delegation, at the end of his speech, representative Wang Jing sang the Buyi folk song "Good Flower Red" emotionally. The general secretary praised her for singing well and asked her to convey good wishes and greetings to the villagers, wishing them a "good bonus" life.

People remember that in the Jiangxi delegation, the general secretary saw Lan Nianying dressed in national costumes and accurately said "You are the She nationality". "Is the farmhouse up?" "Has the expressway reached you?" The general secretary is concerned about their production and life.

People still remember that in the Heilongjiang delegation, Liu Lei, a representative of Hezhe nationality, told the General Secretary that their life now is on the road to happiness, just like the song of Wusuli Boat. The general secretary said that this song has long been familiar, and it depicts the beautiful scene of harmony and unity of the Chinese nation.

A branch and a leaf are always related to love.

When attending the deliberation of the Sichuan delegation this year, the General Secretary of the Supreme Leader said that he had seen reports about the "Cliff Village" in Liangshan Prefecture on TV, especially watching the travel status of the villagers, and he felt very worried. I was a little relieved to learn that a new iron ladder had been built in the local area.

Between a "pull" and a "loose", the general secretary’s deep love for the people is naturally revealed.

Bit by bit, sincere.

"Do farmers and herdsmen go to the hospital now when they have children?" "Is there a health room in the village?" "Some places in Qinghai have a large area. How can farmers and herdsmen see a doctor?" The General Secretary of the Supreme Leader once asked a series of questions to the representative of Niang Maoxian, which made the doctor from the People’s Hospital of Huangnan Tibetan Autonomous Prefecture in Qinghai call him "extremely nervous".

At that time, I fully communicated with the representatives of lifelong loyalty and deeply understood the changes in the production and life of the villagers. Lifelong loyalty happily said to the general secretary: "The people there like you very much!"

"I am extremely nervous" and "I like it very much". The sincere exchanges between the deputies and the general secretary have condensed into the enthusiasm for discussing the country and resonated with hundreds of millions of people.

The historical responsibility of bravely standing on the tide

On the morning of March 7, 2017, the East Hall of the Great Hall of the People was full of high-spirited and energetic positive energy. General Secretary of the Supreme Leader is here to participate in the deliberation of the Liaoning delegation.

Xu Qiang’s representative comes from the front line of enterprise production. He told the general secretary: "A few years ago, I participated in the election of deputies to the National People’s Congress and was not elected. At that time, many people comforted me and said, why did people choose you without smoking a cigarette or drinking a mouthful of wine? Later, I was elected as a deputy to the National People’s Congress. This is the trust of organizations and voters. "

"The right path in the world is vicissitudes." Xu Qiang said that the political atmosphere in Liaoning is getting better and better now, and we should use all our wisdom to strive for perfection and do our job well.

The General Secretary of the Supreme Leader emphasized that it is the political advantage of China’s people’s congress system to have grassroots comrades as deputies to the National People’s Congress.

Last year, the central government severely investigated and dealt with the case of canvassing and bribery in Liaoning. Through serious investigation of cases and in-depth warning education, Liaoning’s political ecology is being restored step by step.

Combined with the painful lessons of Hunan Hengyang’s case of sabotaging the election and Sichuan Nanchong’s case of canvassing and bribing the election, the General Secretary of the Supreme Leader profoundly pointed out that if everyone is in trouble, is it true that the law does not blame the public and it will not happen again? No! The law should blame the public to avoid the future!

Clear problem orientation and firm responsibility. The key to the success of China lies in the Party. Facing the chronic diseases in the party style and political style directly, only by really grasping strict management and stirring up turbidity and clearing up the air can we concentrate our efforts and overcome difficulties.

Strictly administering the Party in an all-round way is a red line that runs through the whole process of governing the country by the CPC Central Committee with the Supreme Leader as the core, and it is also one of the most discussed topics by the General Secretary of the Supreme Leader at the National People’s Congress.

In 2014, when the Anhui delegation participated in the deliberation, the General Secretary demanded that leading cadres at all levels should be strict with self-cultivation, strict use of power, and strict self-discipline, while seeking truth from things, starting a business, and being realistic. The special education of "three strictness and three realities" has been launched, which has continuously led to the deepening of work style construction.

In 2015, when the Jiangxi delegation participated in the deliberation, the General Secretary pointed out that the natural ecology should be beautiful and the political ecology should be beautiful. It is necessary to further promote the anti-corruption struggle and make great efforts to uproot "rotten trees", cure "sick trees" and "crooked trees". Strictly administering the party in an all-round way has shifted from "treating the symptoms" to "treating both the symptoms and the root causes", and the political life within the party has been continuously strengthened.

In 2016, when visiting members of the Democratic National Construction Association of Industry and Commerce, the General Secretary defined a new type of political and business relationship with the words "pro" and "clear", which drew a high line and a bottom line for leading cadres to contact with private enterprises.

When attending the deliberation of the Liaoning delegation this year, the General Secretary once again stressed the importance of strictly administering the party in an all-round way: it is most crucial to promote the revitalization of Liaoning and build a cadre team with high ideological quality, good moral conduct, strong ruling skills and practical work style.

In view of Liaoning’s falsification of economic data, the general secretary said: "Liaoning has made the figures clear, bottomed out and squeezed out the water. Although the figures you took out seem not very good-looking, I think they are actually very good-looking. This is an aboveboard figure. The Party Central Committee supports you to do so. Really relying on hard work and unremitting efforts to get the economy going, this is the backbone of Chinese. " The general secretary’s words won warm applause from the delegates.

The General Secretary of the Supreme Leader firmly said: "We should really select cadres who are loyal to the cause of the Party and the people, be upright and have clean officers, so that those who do not act can’t sit still, those who fool can’t have a future, those who run officials and want officials can’t have a market, and those who buy and sell officials can be severely punished, forming a good political ecology with a clean atmosphere."

Adhering to the party’s leadership, the people being the masters of the country and governing the country according to law are the distinctive features of Socialism with Chinese characteristics’s political development.

From one meeting to five meetings, the General Secretary of the Supreme Leader had in-depth exchanges with the deputies on comprehensively administering the country according to law.

Promoting the reform of state-owned enterprises depends on the rule of law — —

It is necessary to establish and improve a unified regulatory system and basic management system for state-owned assets, realize full coverage of the regulatory system for state-owned assets, fully implement the responsibility of maintaining and increasing the value of state-owned assets, and prevent the loss of state-owned assets and major risk events.

Further opening up depends on the rule of law — —

It is necessary to closely focus on building an open economic system, promote the rule of law in the field of foreign economic relations and trade, strengthen legal services for various economic entities, and create a fair and orderly legal environment for economic development.

Ensuring the security and stability of border areas depends on the rule of law — —

Increase investment in border areas, strengthen social governance according to law, further promote peace building, control border order according to law, and maintain security and stability in border areas.

Promoting the modernization of national governance system and governance capacity depends more on the rule of law — —

Adhere to and improve the system of regional ethnic autonomy, and put accelerating the development of ethnic areas and safeguarding the legitimate rights and interests of ethnic minorities into the track of rule of law.

Administer the party with the system, and govern the country according to the law and the constitution. The CPC Central Committee with the Supreme Leader as the core stands at the overall height of the country’s long-term stability, firmly adheres to and develops the country’s fundamental political system and basic political system, and shows the broad mind of leading the times and the historical responsibility of being brave in self-revolution.

Future-oriented strategic choice

In 2017, the development process of China stepped on an important node — —

From the 18th National Congress of the Communist Party of China to building a well-off society in an all-round way, the eight-year process has been over half.

From the early 1980s, China took the "three-step" strategic step of modernization, and basically achieved the goal of modernization by the middle of this century, the process is just over half.

When the boat reaches the middle stream, it is brave to make progress.

Grasping the general tone of striving for progress while maintaining stability, adapting to the new normal of economic development and firmly establishing new development concepts, China must gather new development momentum on the road ahead.

"Firmly implement the new development concept, deepen reform and opening up, and lead the innovation drive."

From one meeting to five meetings, the General Secretary of the Supreme Leader will attend the deliberation of his Shanghai delegation every year. Reform, opening up and innovation drive are the topics that must be discussed.

This year, when talking about the construction of the Shanghai Pilot Free Trade Zone, the General Secretary pointed out that "the door of China’s opening will not be closed" and asked Shanghai to "further demonstrate the role of comprehensively deepening reform and expanding the experimental field, and show China’s clear attitude of opening to the world in all directions".

Driven by reform, opening up and innovation. In 2014, General Secretary of the Supreme Leader also put forward this proposition when attending the deliberation of the Guangdong delegation of the Second Session of the 12th National People’s Congress.

General Secretary of the Supreme Leader used the words "cage for birds, phoenix nirvana". He said that the cage is not an empty cage. It must be erected first and then broken. It is also necessary to study where the "new bird" enters the cage and where the "old bird" goes. Efforts should be made to promote industrial optimization and upgrading, give full play to the driving role of innovation, take the road of green development, and strive to achieve phoenix nirvana.

Compared with the pioneers of reform and opening up such as Guangdong and Shanghai, the old industrial bases such as Northeast China are facing more severe pain of structural adjustment.

Five national conferences and four delegations from three northeastern provinces. The revitalization of Northeast China is an issue of great concern to the Supreme Leader General Secretary.

In the delegations of Liaoning, Jilin and Heilongjiang, General Secretary of the Supreme Leader repeatedly stressed: "The revitalization and development of old industrial bases such as Northeast China can no longer be sung ‘ Industry is a pillar of the sky, with a single structure ’ ‘ Errenzhuan ’ Do addition, subtraction, multiplication and division. "

On March 7 this year, in the Liaoning delegation, the General Secretary clearly expounded his profound thinking on this issue when communicating with the representative of Tang Fuping, Chairman of Angang Group.

The general secretary asked: "Is the development direction of Angang going to reduce production capacity, maintain production capacity or increase production capacity?" Tang Fuping said that Angang has the task of de-capacity. At first, I was worried about whether the production capacity could really be removed, but after more than a year of hard work, I have already felt the benefits brought by de-capacity. In the next step, good production capacity should be retained, and the backward ones should be resolutely removed.

"Be sure to adjust the structure." The general secretary said earnestly that structural adjustment must not be carried out in the same way, so that "zombie enterprises" can linger on. We must change birds in cages, and finally reach the realm of phoenix nirvana and rebirth. Long pain is better than short pain.

The General Secretary further pointed out: "Supply-side structural reform is an inevitable choice for China’s economic development to enter a new normal, an inevitable choice for implementing the new concept of development under the new normal, an effective and good strategy to deal with the contradictions and difficulties faced by China’s economic development, and the only way to revitalize Liaoning."

This year is the deepening year of supply-side structural reform.

In fact, in recent years, General Secretary of the Supreme Leader has made a series of important conclusions on different occasions such as Jiangsu delegation and Hunan delegation. Last year and this year, special requirements were put forward for the structural reform of agricultural supply side.

Pursuing green development is also the proper meaning of transforming development kinetic energy and realizing sustainable development.

Lucid waters and lush mountains are invaluable assets.

In the Jiangxi delegation, the general secretary vividly described: "The environment is people’s livelihood, the green hills are beautiful, and the blue sky is also happiness."

In the Qinghai delegation, the General Secretary made a clever metaphor: "Protect the ecological environment like eyes and treat it like life."

In the delegation of Heilongjiang, the General Secretary earnestly entrusted: "Delineate the red line of ecological protection, strengthen environmental governance, reserve space for sustainable development, and leave a beautiful home with sky blue, green land and clear water for future generations."

… …

Find the driving force of reform in innovation and stimulate the vitality of innovation in reform.

Talent is the key to innovation.

General Secretary of the Supreme Leader paid special attention to giving full play to the advantages and characteristics of Chinese People’s Political Consultative Conference’s talented members. In 2013, when attending the joint meeting of members of the Association for Science and Technology and the scientific and technological circles, he pointed out that it is necessary to deepen the reform of the scientific and technological system and change "I want to innovate" into "I want to innovate". It is necessary to strengthen the construction of scientific and technological talents and provide a broader world for talents to play their roles and display their talents.

In 2017, at the joint meeting of members of the Democratic Progressive Party, the Agricultural Workers’ Party and the Jiu San Society, the General Secretary of the Supreme Leader specially emphasized stimulating the innovative vitality and potential of intellectuals and gathering talents from all over the world to use them. He also responded to the speeches of nine members, including Yao Aixing, and affirmed the initiative and positive actions of the broad masses of intellectuals, hoping that they would make more contributions to the country’s prosperity, national rejuvenation and people’s happiness.

"The responsibility of strengthening the army has historically fallen on our shoulders. To provoke this burden, we must dare to take responsibility. This is not only the expectation of the party and the people, but also the political character that contemporary revolutionary soldiers should have." The entrustment of the General Secretary of the Supreme Leader has aroused the unprecedented high fighting spirit of the soldiers of the whole army.

— — To achieve the goal of strengthening the army, we must seize the strategic opportunity to deepen the reform of national defense and the army;

— — Promoting integration of defense and civilian technologies’s development to a national strategy is a major decision made from the overall situation of national security and development strategy;

— — The army should strengthen its sense of purpose and mass concept, actively participate in and support local economic and social construction, and benefit the people with practical actions;

— — Promote political army building, reform and strengthen the army, manage the army according to law, strengthen army building and preparations for military struggle, and ensure the second step of the "three-step" development strategy of national defense and army modernization as scheduled;

— — We will make greater efforts to promote the army through science and technology, persist in fighting against scientific and technological innovation, and provide strong scientific and technological support for our army’s construction.

General Secretary of the Supreme Leader attended the plenary session of the PLA delegation five times, and made a series of important arrangements around the goal of building a people’s army that listens to the party’s command, can win battles and has a good style of work under the new situation, which provided a fundamental follow-up for realizing the dream of strengthening the army.

Actively and steadily promote urbanization, strengthen and innovate social governance, ensure national food security, build spiritual civilization, and develop cross-strait relations … … Looking at the overall situation, observing the general trend, discussing major issues and making plans, from one meeting to five meetings, from the NPC delegation to the joint meeting of the CPPCC, the General Secretary of the Supreme Leader discussed the reform and development plan with the delegates and members, and learned the wisdom and strength of governing the country from the people, which opened a colorful era scroll of China’s reform and development.

In 2017, the curtain of the two national conferences will fall. Delegates and Committee members, with the great trust of the CPC Central Committee with the Supreme Leader as the core, are full of confidence to move toward a broad world of practice, pass on the Party’s ideas and the will of the country to hundreds of millions of people, and jointly greet the victory of the 19th National Congress of the Communist Party of China with practical actions.

To achieve the goal of "two hundred years" and realize the Chinese dream of the great rejuvenation of the Chinese nation, China is moving towards a more magnificent journey.

Reporter: Huo Xiaoguang, Zhang Xudong and Luo Yufan.

Photography: Lan Hongguang, Li Xueren, Ma Zhancheng, Rao Aimin, Xie Huanchi, Ding Lin, Li Gang, etc.

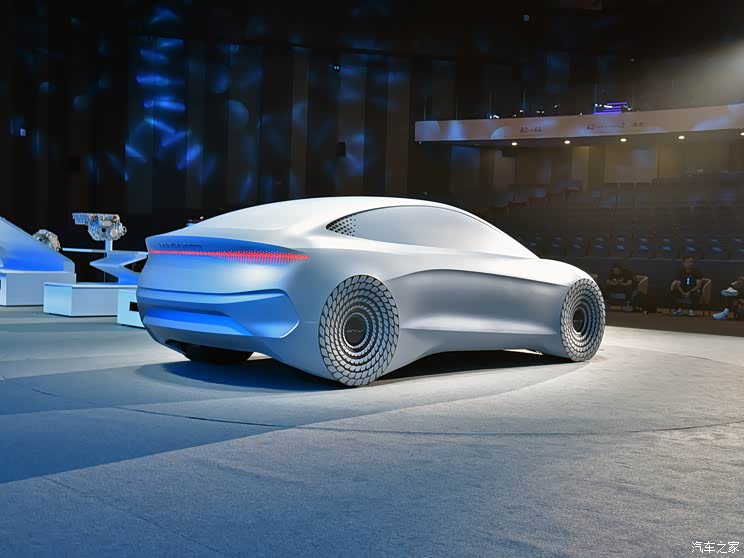

As the core fulcrum of China FAW’s strategy of "doing its best, liberating and galloping", the transformation practice of FAW Pentium is a typical sample of new energy breakthrough of central enterprises. Through the "triple leap" of institutional mechanism reform, technical system reconstruction and capital operation upgrade, this car company with profound historical background is attacking the first camp of independent brands with a brand-new attitude, and its strategic transformation path provides a valuable paradigm for the industry.

As the core fulcrum of China FAW’s strategy of "doing its best, liberating and galloping", the transformation practice of FAW Pentium is a typical sample of new energy breakthrough of central enterprises. Through the "triple leap" of institutional mechanism reform, technical system reconstruction and capital operation upgrade, this car company with profound historical background is attacking the first camp of independent brands with a brand-new attitude, and its strategic transformation path provides a valuable paradigm for the industry. This reform brings not only the optimization of capital level, but also the revolutionary change of decision-making mechanism-the decision-making chain is shortened by 30%, the product development cycle is greatly shortened, the salary system introduces the excess profit sharing mechanism, and the stability of the core team is significantly improved.

This reform brings not only the optimization of capital level, but also the revolutionary change of decision-making mechanism-the decision-making chain is shortened by 30%, the product development cycle is greatly shortened, the salary system introduces the excess profit sharing mechanism, and the stability of the core team is significantly improved. On the development level of vehicle platform, the newly-built cross-shadow architecture adopts the modular design concept, integrating five technical modules: ultra-light architecture, ever-changing comfort, smart energy efficiency, Starway chassis and rock safety. Through the extensible wheelbase adjustment mechanism, the rear seat space of the platform is increased by 15% compared with that of the same class. With the intelligent thermal management system, the battery performance can still be stable in the harsh environment from -35℃ to 60℃. The digital chassis adjustment technology realizes the roll control ability of 1.84 g/100 and compresses the braking distance to less than 36 meters, which significantly improves the dynamic performance of the vehicle.

On the development level of vehicle platform, the newly-built cross-shadow architecture adopts the modular design concept, integrating five technical modules: ultra-light architecture, ever-changing comfort, smart energy efficiency, Starway chassis and rock safety. Through the extensible wheelbase adjustment mechanism, the rear seat space of the platform is increased by 15% compared with that of the same class. With the intelligent thermal management system, the battery performance can still be stable in the harsh environment from -35℃ to 60℃. The digital chassis adjustment technology realizes the roll control ability of 1.84 g/100 and compresses the braking distance to less than 36 meters, which significantly improves the dynamic performance of the vehicle. A complete ecosystem has been built in the field of intelligent cockpit. The Ruyi cockpit based on FEEA3.0 electronic architecture integrates Huawei MDC810 intelligent driving chip and Horizon Journey 5 series AI processor to realize L2+ automatic driving function. Iflytek’s customized voice system supports accurate multi-tone recognition, and Volcano Engine’s AI model enables personalized interactive experience, and the response speed of the system reaches the flagship level of consumer electronics.

A complete ecosystem has been built in the field of intelligent cockpit. The Ruyi cockpit based on FEEA3.0 electronic architecture integrates Huawei MDC810 intelligent driving chip and Horizon Journey 5 series AI processor to realize L2+ automatic driving function. Iflytek’s customized voice system supports accurate multi-tone recognition, and Volcano Engine’s AI model enables personalized interactive experience, and the response speed of the system reaches the flagship level of consumer electronics. The channel resources carried by strategic investors inject strong momentum into market expansion. Referring to the industry benchmark case that Yancheng base was completed and put into operation 18 months after yueda Group took a share, the injection of new capital will accelerate the release rhythm of the annual production capacity of 400,000 vehicles in the North-South dual base.

The channel resources carried by strategic investors inject strong momentum into market expansion. Referring to the industry benchmark case that Yancheng base was completed and put into operation 18 months after yueda Group took a share, the injection of new capital will accelerate the release rhythm of the annual production capacity of 400,000 vehicles in the North-South dual base. Substantial progress has also been made in the construction of service ecology. Through the introduction of the policy of "Lifetime Warranty 2.0 for the whole vehicle and three power plants", FAW Pentium took the lead in realizing "equal rights in warranty" in the industry, and with the layout of 200 new energy exclusive exhibition halls, formed a closed-loop service covering the whole life cycle of products.

Substantial progress has also been made in the construction of service ecology. Through the introduction of the policy of "Lifetime Warranty 2.0 for the whole vehicle and three power plants", FAW Pentium took the lead in realizing "equal rights in warranty" in the industry, and with the layout of 200 new energy exclusive exhibition halls, formed a closed-loop service covering the whole life cycle of products. Opportunities and challenges coexist. Under the background of intelligent competition entering the "Infrastructure Year", how to keep the speed of technology iteration? How to copy past successful experiences? These all need to give systematic solutions at the level of strategic implementation.

Opportunities and challenges coexist. Under the background of intelligent competition entering the "Infrastructure Year", how to keep the speed of technology iteration? How to copy past successful experiences? These all need to give systematic solutions at the level of strategic implementation.