Consumer loan, you have to run steadily to run fast. Where can I apply?

Source: China People’s Bank, wind information Cartography: Cai Huawei.

Preventing and resolving major risks is one of the three major battles in the decisive period of building a well-off society in an all-round way. Financial security is not only related to the overall economic situation, but also closely related to people’s lives. Especially in recent years, various emerging financial platforms and products have emerged in an endless stream. While solving the "pain point" of demand, new technologies and new means have also brought some hidden risks. Many financial security problems are emerging from people and gradually accumulating and expanding.

Starting from me, everyone is the first gatekeeper of financial risks by understanding financial knowledge, enhancing risk prevention awareness and cultivating a rational view of wealth. Starting from today, this newspaper launched a series of reports "Rejecting the financial risks around us", focusing on three areas that are closely related to daily life but also need to be regulated — — Consumer loan market, payment industry and internet insurance, introduce new financial products, rationally analyze possible hidden risks, explore ways to resolve risks, and make people’s financial life safer and more satisfactory.

Convenient and quick, refueling for consumption.

From high-end furniture, jewelry and antiques to digital products, refrigerators and televisions, consumer loans have supported the rapid development of the retail consumer market.

"In August this year, the whole family was preparing to travel abroad. At that time, it was just in time to pay the English training fee for the children. It cost about 70,000 to 80,000. Unfortunately, at that time, the money was a little tight, so I thought I could borrow some money." Xing Hui, an employee of a state-owned enterprise in Nanjing, finally chose a bank consumer loan with lower interest rate after comparing the products of banks and Internet financial platforms.

Because it was only a short-term emergency, Xing Hui borrowed it for one month, with a quota of 50,000 yuan, and the interest rate was three ten thousandths per day, so the annual interest rate was about 10%. "Maybe it’s because I had a good credit in the bank before, and the loan approval was particularly fast. Apply on mobile banking, and after a few hours, 50,000 yuan will arrive. " Xing Hui said. After the repayment, the bank called to show the consumption details, and Xing Hui photographed the payment voucher and sent it, which passed smoothly.

But recently, loans have not been so "loose". "I want to apply for short-term consumer loans these days, and I found that the bank’s pre-loan review is strict, and the materials required are more specific. Bank staff said that it is necessary to strictly review the use of loans at all levels to apply for consumer loans now. " Xing Hui said.

In addition to banks, consumers can also obtain loans from consumer finance companies, e-commerce platforms, Internet staging platforms and small loan companies. More and more young people are beginning to try new ways of consumer loans.

Wen Nie just graduated from school of visual arts, Shanghai, majoring in photography. During his internship at the TV station, Wen Nie had a wish to photograph the natural beauty of his hometown Shennongjia with drones. After comparing prices on various e-commerce platforms, Vinnie finally chose to buy a DJI UAV in 24 phases on an e-commerce platform, just in time for the interest-free activities of the platform, and the repayment for each phase was only 225 yuan.

"At that time, I could get an internship salary of more than 2,000 yuan per month, and the repayment pressure was not great, so I didn’t need to reach out to my parents for money. Now, I am used to buying various electronic products by installment, such as mobile phones and computers that I use now, all of which are bought in this way. " Vinnie said.

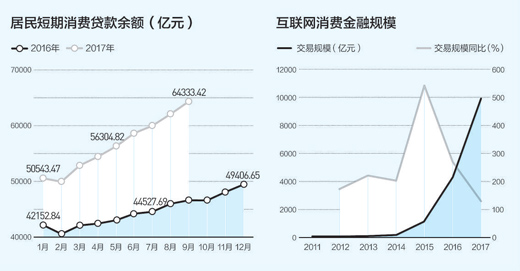

In recent years, consumption has replaced investment as the first driving force of economic growth, which is inseparable from financial support. According to the data of the People’s Bank of China, this year is 1-mdash; In September, residents added 1.49 trillion yuan of short-term consumer loans, which was 1.79 times that of last year. Consumer finance showed explosive growth. From high-end furniture, jewelry and antiques to digital products, refrigerators and televisions, there are corresponding financial services and products in various consumer fields.

"Residential sector loans include mortgage loans and consumer loans. In recent years, the financing balance of the residential sector has risen rapidly. By the end of 2016, the balance of residential mortgage loans in China was about 20 trillion yuan, and the balance of consumer loans was only five or six trillion yuan. Mortgage loans were equivalent to about four times that of consumer loans. In mature markets such as the United States, the debt balance of the residential sector exceeds that of the enterprise sector, and the proportion of mortgage loans and consumer loans is equivalent in the financing balance of residents. It is conceivable that with the development and upgrading of the consumer market and financial products in the future, there is still a lot of room for growth in consumer loans. " Ceng Gang, director of the Banking Research Office of the Institute of Finance of China Academy of Social Sciences, said that if the growth rate of 20% is predicted, the scale of China’s consumer credit will exceed 12 trillion yuan by 2020.

The down payment is not enough, and consumer loans come together.

Due to the differences in customer groups and risk control capabilities, the proportion of consumer loans provided by various financial and non-financial institutions may be higher.

While boosting people’s consumption, there are also many problems in the consumer loan market, such as numerous participating institutions, mixed fish and dragons, lax examination of the qualifications of lenders, and inadequate supervision of the amount and use. Coupled with the irrational consumption and borrowing of borrowers, consumer loans are transformed into "down payment loans" and "investment loans", which breeds potential risks.

At the beginning of this year, Chen Jing, an employee of a cultural enterprise in Beijing, wanted to change the school district for her children. Suddenly, the purchase restriction policy was introduced intensively, and Chen Jing panicked, fearing that the subsequent cost of buying a house would be higher and higher. The seller who talked about it also felt that he could not wait any longer, for fear that the house price would fall. Together, the two families decided to pay a quarter of the total price of the house as a down payment, and passed the house first.

I haven’t sold my house, and I have to pay millions of yuan for it. Where did so much money come from? Chen Jing pieced together several million yuan, and the remaining fund gap can only be solved by loans. "At that time, it was more convenient to apply for a loan from the bank. The bank saw that my previous credit record was relatively good, and quickly gave me a credit loan. The money was directly transferred to the account, and then I could control it freely. As long as the repayment can be made on time, the bank should not be too concerned about how to use the money. " Chen Jing said that the interest rate is acceptable, which is about 30% higher than the benchmark interest rate. "Now the mortgage has not been fully completed. When the mortgage and credit loan are paid together, the pressure is still not small, and it will cost about 40,000 yuan a month."

Chen Jing learned that in addition to this kind of loans directly transferred to the borrower’s account, some banks’ loans give the borrower a spending limit, which requires actual consumption behavior before they can be used. But this is not without a "flexible" approach, you can find a merchant to cash out, as long as you pay a certain handling fee.

"Now bank loans are much stricter, and it is difficult to get a maximum loan of 1 million yuan, which is basically about 300,000 yuan, and the interest rate has also risen a lot. Asked a few months ago, it is basically at least 40%. " Chen Jing learned that recently, it began to strictly investigate the flow of consumer loans, cracked down on down payment loans, and banks strictly controlled the misappropriation of personal consumer loans to purchase houses.

Looking at the unclear flow of consumer loans, we can’t just stare at banks. "There are also various types of financial and non-financial institutions that provide consumer loans, and there is also the possibility of entering the property market, and the proportion is higher. This year, the special rectification of Internet finance continued, and the number of platforms in peer-to-peer lending decreased, but the trading volume of platforms increased. The data shows that in the first half of the year, the national online loan turnover reached 1.93 trillion yuan, a year-on-year increase of 72.81%. At the same time, the loan balance of small loan companies reached 960.8 billion yuan in the first half of the year, an increase of 31.3 billion yuan over the beginning of the year, which was the first time in the past three years. Online lending platforms and small loan companies do not monitor the flow of funds, and the possibility of misappropriation of funds is high. There are also a few platforms and intermediaries that directly provide loan support for the down payment of house purchases. " Dong Ximiao, a senior researcher at Chongyang Financial Research Institute of Renmin University of China, said.

Different customer groups and different risk control capabilities also make risks more concentrated in the field of consumer loans outside banks. "Different consumer platforms serve different people and face different risks. The customers served by commercial banks have stable income, good credit records, rational consumption concepts and relatively controllable risks. And serving students, migrant workers, blue-collar workers, etc. ‘ Long tail crowd ’ The risk of consumer finance platform will be higher. Under normal circumstances, the platform’s risk control ability is insufficient, and the consumption scene is missing. It will choose to cover high risks with too high interest rates. The consequences of this will breed circular risks, causing long-term borrowing, borrowing new and returning old, and inappropriate collection methods. " He Fei, a senior researcher at the Development Research Department of Bank of Communications, analyzed.

Fill the gap and protect consumers.

Some platforms have insufficient information disclosure, and the interest rate is not high, but when all kinds of expenses are added up, the comprehensive cost is very high.

The risk can’t be underestimated, but the turbidity current is not mainstream. Risk trigger points such as loan misappropriation and excessive borrowing are not the main reasons for the rapid growth of consumer loans.

"The real reason for promoting the growth of residents’ short-term consumer credit scale is that in the process of consumption upgrading, the credit demand space of retail customers is gradually opened. With the rising income level of residents and the improvement of consumption and payment technology, people’s demand for consumer financial products will become stronger and stronger, and the consumer loan market and the retail market complement each other and promote each other. " Ceng Gang said, of course, we should also pay attention to the possible impact of excessive leverage in the residential sector.

The "melee" between financial institutions and non-financial institutions should be changed, and all kinds of institutions engaged in consumer loan business should be strengthened in supervision, and unified regulatory standards and requirements should be applied without discrimination.

"The sources of lending funds for many platforms are unclear and there is a risk of long-term lending, which implies that the flow of funds between platforms is quite frequent. Supervision must first find out the source of funds for platforms. Secondly, it is necessary to conduct in-depth investigation on the customer acquisition method, risk control and scenario expansion of a single platform, and eliminate and clean up a number of informal consumer finance platforms. And check the legality of all subjects in the consumer loan ecological chain, including the consumer loan platform itself, the Internet giants and other diversion platforms, personal credit reporting pilot institutions, third-party collection agencies, third-party data providers, etc., and severely crack down on interest collusion and illegal interest transfer. " He Fei said that we can learn from some foreign experiences, strengthen supervision, and strengthen legislation and market access mechanisms. In particular, it focuses on the access standard, licensed operation, interest rate ceiling setting, loan use limitation, platform exit mode, etc.

There must be comprehensive and perfect consumer protection laws and regulations. Ceng Gang introduced that in mature markets such as the United States, institutions engaged in consumer credit have higher entry barriers, and the regulatory rules concerning retail business are more stringent than those concerning public business. These countries think that the customers of retail business are less able to identify risks than companies and need protection more. On the contrary, the consumer credit market has developed relatively late and its scale is not large. Before, it focused more on protecting the interests of financial institutions and neglected the protection of lenders. In the future, with the continuous development of the consumer loan market and more and more people involved, it is even more necessary to fill the gap and escort everyone’s financial life with regulations.

"Now some platforms have insufficient information disclosure. The interest rate mentioned is not high, but when all kinds of expenses are added together, the comprehensive expenses are very high. " Ceng Gang said that some platforms use this way to induce consumers to borrow excessively, without making borrowers fully aware of the troubles and consequences that high interest rates may bring to themselves. In particular, minors, or students who are not deeply involved in the world, have a vague understanding of risks and are more likely to over-consume and over-borrow.

In the long run, we should speed up the construction of an honest society and improve the personal credit information system. He Fei said that at present, the construction of China’s credit system is still difficult to support the rapid development of the credit society, and the personal credit information system lags behind the development of credit, which leaves a loophole for illegal platforms. The regulatory authorities should cooperate with public departments, formal financial institutions, licensed consumer finance companies, large-scale Internet platforms, personal credit reporting pilot institutions, large-scale data companies, etc. to jointly promote data information sharing and market-oriented credit reporting system construction and support the development of consumer credit business.

For individual residents, they should borrow reasonably and control leverage according to their own economic ability. Dong Ximiao said that in general, the monthly repayment expenditure should be controlled below half of the household income, and it is best not to exceed one third.

Consumer finance company’s products have small single credit line and fast approval; Internet consumer finance embeds consumption scenes.

Where can I apply for a consumer loan? (Extended reading)

At present, the institutions engaged in consumer finance business in the market can be roughly divided into four categories: commercial banks, consumer finance companies approved by the China Banking Regulatory Commission, Internet consumer finance, including e-commerce platforms and Internet staging platforms, and other institutions such as small loan companies.

commercial bank

Commercial banks engage in consumer finance mainly through the following three forms: first, holding or participating in consumer finance companies; The second is to cooperate with various e-commerce platforms to realize the extension of consumption scenarios. The third is to independently launch credit products and build an e-commerce platform. Commercial banks have a huge customer base and massive user consumption data, so they can provide diversified innovative credit products through the analysis of customers’ consumption habits and credit ratings.

consumer finance company

Consumer finance companies are positioned as a supplement to traditional banks, mainly targeting low-and middle-income groups and emerging customer groups. Compared with banks, it has unique advantages and competitiveness because of its small single credit line, fast approval, no mortgage guarantee and flexible service.

The current business models of consumer finance companies can be divided into three categories. One is mainly based on offline channels; A main online and offline e-commerce model; There is also a category that positions itself as an Internet finance company.

Internet consumer finance

With the popularity of the Internet, the combination of the Internet and consumer finance is closer, and all aspects of traditional consumer finance activities have realized electronization, networking and informationization, greatly improving the efficiency of consumer finance. Compared with traditional consumer finance, Internet consumer finance has distinct characteristics: massive data support, enhanced user experience, and the embedding and penetration of consumer scenes to make up for the lack of traditional consumer finance in the segmentation field.

According to the report released by the National Finance and Development Laboratory, Internet consumer finance includes the following representative modes: one is the consumer finance of e-commerce platform, represented by Ant Financial, Jingdong Finance and Suning Finance; One is Internet consumer finance in market segments; One is the main installment shopping Internet consumer finance platform; One is the platform that focuses on mobile credit.

Other institutions

There are also some microfinance companies involved in consumer finance. Take AEON Group as an example, its microfinance company in Shenyang provides customers with installment payment services for durable consumer goods such as household appliances and furniture, which can achieve 30-minute approval, fixed monthly repayment, and no need for credit card or mortgage guarantee.

(Ouyang Jie, Song Chao Chai Jin finishing)