Regarding the pledge of 13.4 billion deposits, Evergrande took China Evergrande to court.

With regard to "the deposit of 13.4 billion yuan of Evergrande Property was pledged by relevant banks", the latest progress was made, and Evergrande Property put China Evergrande in the dock.

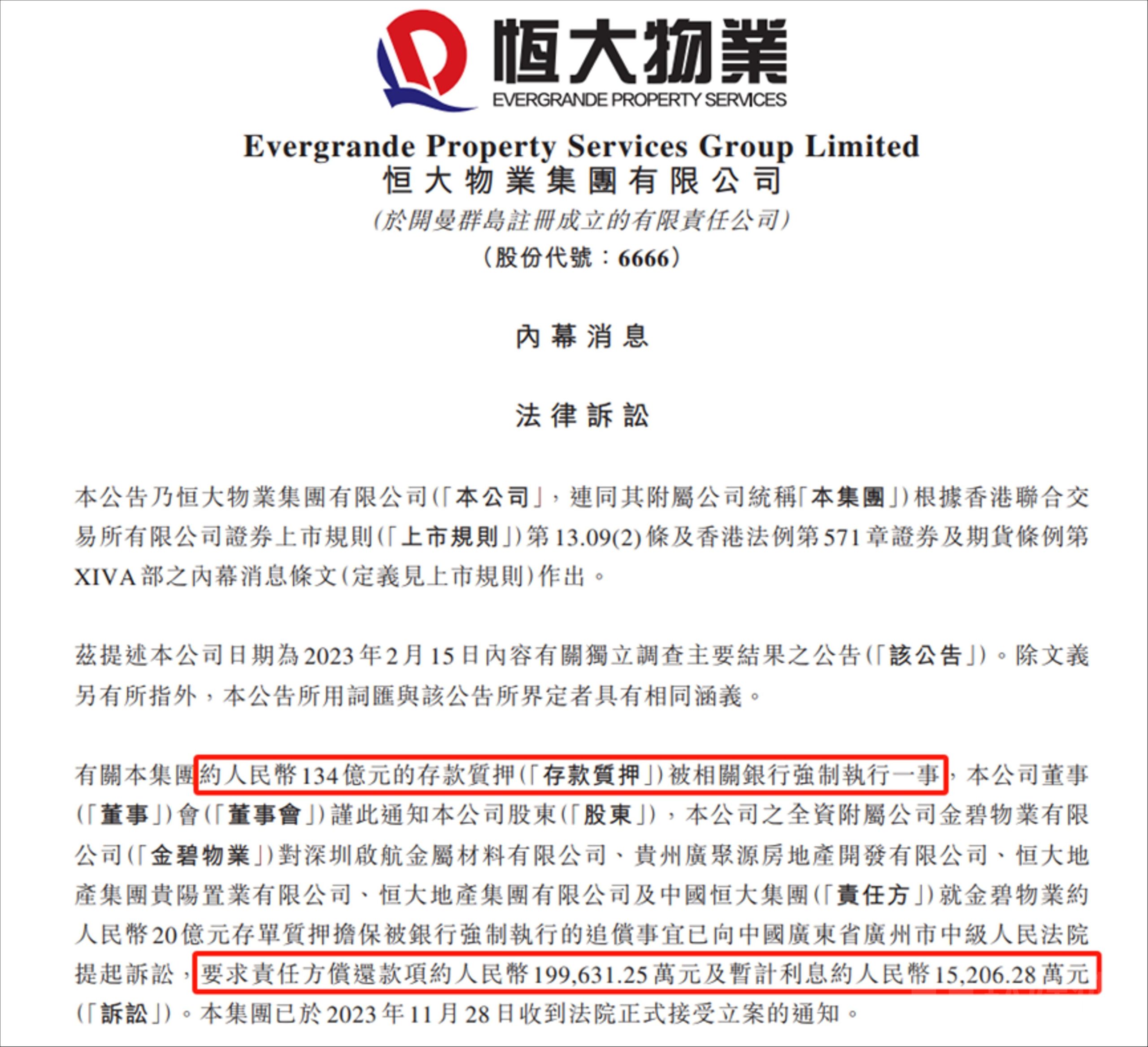

On November 28th, Evergrande Real Estate announced that about 13.4 billion yuan of deposit pledge of the Group (Evergrande Real Estate and its subsidiaries) was enforced by relevant banks, and jinbi property Co., Ltd., a wholly-owned subsidiary of the Company, had recourse against Shenzhen Qihang Metal Materials Co., Ltd., Guizhou Guangjuyuan Real Estate Development Co., Ltd., Evergrande Real Estate Group Guiyang Real Estate Co., Ltd., Evergrande Real Estate Group Co., Ltd. and China Evergrande Group (the responsible party) for about 2 billion yuan of deposit pledge guarantee enforced by banks in jinbi property.

According to the announcement, Evergrande Property requested the responsible party to repay more than 2 billion yuan, including the original amount of about 1.996 billion yuan and provisional interest of about 152 million yuan. On November 28th, Evergrande Property received a formal notice from the court to accept the case.

Evergrande Property stated in this announcement that according to the analysis of the board of directors and its legal counsel,The lawsuit will not have a significant adverse impact on its daily business operations, and the company will continue to make every effort to recover the relevant deposit pledge.Further announcements will be made in due course on any significant progress in the above litigation or any other actions taken.

The dispute between Evergrande Property and Evergrande was triggered by the huge pledge deposit disclosed in March 2022.

On March 22, 2022, Evergrande Property disclosed that during the audit of the 2021 financial report, the company found that about 13.4 billion yuan of deposits were pledged by third parties and were enforced by relevant banks.

The "13.4 billion yuan deposit pledge" incident has a great impact and a wide range of implications, and it is also one of the important factors that led to the suspension of the Evergrande Department for a long time. Therefore, Evergrande set up an independent investigation committee and appointed experts to investigate the pledge.

According to the independent investigation results of the previous "13.4 billion yuan deposit pledge" incident, during the period from December 28, 2020 to August 2, 2021, six subsidiaries of Evergrande Property (jinbi property, Jinbi Hengying, Jinbi Huafu, Evergrande Hengkang, Jinbi Shijia and Jinbi Hengkang) provided this pledge to a number of third-party companies (as the guaranteed parties) through eight domestic commercial banks in China.

The purpose of this pledge is to continue to use the special financing business to obtain funds for other operational and financial needs of the Group, including paying liabilities and/or payables due at different times in 2021.

It is reported that from September to December, 2021, due to the expiration of the pledge guarantee period, the conditions for the realization of the pledge right were triggered, and the total value of the deposit certificate pledge of the subsidiary company of Evergrande Property, which was enforced by the bank, was 13.4 billion yuan.

According to the previous announcement issued by Evergrande Property, the pledge is divided into three groups, the first group is 2 billion yuan, the second group is 2.7 billion yuan, and the third group is 8.7 billion yuan. What Evergrande Property recovered from China Evergrande this time was the first group of deposits.

The background and reason for the pledge is that in the middle to late December of 2020, based on the capital demand of Evergrande, the Group proposed to launch a special financing business. The specific scheme is to use the subsidiary company to pledge to provide guarantee for the third party to apply for financing from the bank, and the funds obtained from the third party financing will be invested in the Group to pay the liabilities and/or payables in February of 2021.

Further investigation shows that among the directors in the relevant period, Xu Jiayin, Xia Haijun and Pan Darong have access to and hold relevant documents, which may enable them to pay attention to the company’s capital situation. Xu Jiayin used to have documents that might draw his attention to potential financial problems, but he said that he did not review these documents because no one specifically reminded him of them. The consultant of the Independent Investigation Committee noticed that this was consistent with his previous statement that although he would receive many reports, he did not read them, because at the critical time, he was not in charge of the company’s finance and funds, but relied on the senior executives responsible for finance and funds to handle related matters.

The independent investigation also found that some documents related to the pledge guarantee arrangement were signed by Xu Jiayin, involving the cross-border transfer of funds from some domestic subsidiaries of the group to the company and the approval of the use of funds to redeem overseas bonds in advance. The internal approval document signed by Xu Jiayin did not clearly indicate that it was related to Evergrande Property, but only mentioned the internal funds of the Group.

The above funds come from the funds raised by the listing of Evergrande Property. According to the results of the supplementary independent investigation, after the proceeds from the initial public offering of Evergrande Property were remitted, because there was no special account for the proceeds at that time, the proceeds were confused with the self-owned funds of Evergrande Property, which were used for the daily operation of the company, resulting in the failure to find out in time that the relevant funds were used for the pledge guarantee arrangement.

Evergrande Property said that after learning of the pledge, it immediately carried out internal control review, personnel adjustment and other remedial measures, accepted the suggestion of the Independent Investigation Committee, implemented various remedial measures, and continued to carry out recovery work from third parties and Evergrande Group.

Many people in the industry believe that it is difficult for Evergrande Property to recover this sum because China Evergrande is in trouble.In August this year, Evergrande Property stated that it had not yet reached a repayment plan with China Evergrande. Meanwhile, the property management of Evergrande assessed the recoverability of this sum and made full provision for the 13.4 billion yuan receivable.

Compared with the other two listed companies of Evergrande, China Evergrande and Evergrande Automobile, Evergrande Property is one with relatively good fundamentals.

Evergrande mentioned in the newly disclosed resumption guidelines that the company has sufficient assets for business operation. In 2022, the total operating income was about 11.81 billion yuan, gross profit was about 2.72 billion yuan, and net profit was about 1.48 billion yuan.

According to the interim financial report for 2023 released by Evergrande Property, the revenue in the first half of the year was 6.145 billion yuan, an increase of 6.2% compared with 5.788 billion yuan in the same period of 2022, of which the revenue from non-related parties accounted for about 98.9%; The net profit was 790 million yuan and the net interest rate was about 12.9%.

During the reporting period, the contracted management area of Evergrande’s property was about 812 million square meters, and the managed area was about 509 million square meters. In the first half of the year, the contracted area was 15.14 million square meters, of which 93.3% came from third parties.

In terms of accounts receivable, the trade receivable of Evergrande Property during the reporting period was 3.244 billion yuan, an increase of 18.44% compared with 2.739 billion yuan on December 31, 2022; In addition, other receivables except trade receivables increased from about 460 million yuan on December 31, 2022 to about 544 million yuan in the reporting period.

In this regard, Evergrande Property also explained in the interim report that the increase in the company’s accounts receivable was mainly due to the increase in the total income of the group and business expansion, and the increase in the balance of deposits and advances on behalf of owners.

The mid-year report also pointed out that in 2023, the company seriously reflected on the nature of the property industry, no longer blindly pursued rapid scale expansion, bid farewell to extensive growth, and instead pursued high-quality, high-quality and profitable sustainable development.

(This article first appeared in Titanium Media APP, author | Wang Jian)

For more macro research on dry goods, please pay attention to WeChat official account, an international think tank of titanium media.